Our Services

will provide Solutions beyond traditional financing

SCROLL

In corporate finance, we offer our clients comprehensive advisory services globally, with a primary focus on capital raising services in the energy sector (Oil & Gas, Nuclear, Renewables).

1.1 Mergers & Acquisitions (M&A)

We offer our clients comprehensive M&A advisory services. We support our clients during all stages of their M&A activities.

Our services include:

Pre-execution

Execution

Post-execution

We design customized solutions in order to support our clients' strategic initiatives, such as geographic expansion and vertical integration.

We assist our clients in finding the right partner(s) in order to complete commercial, technical, legal and financial due diligence.

We provide structuring and valuation services to our clients. This includes comprehensive valuation of target companies, as well as determining the optimal capital structure through holistic financial analysis and financial modeling.

We further assist our clients in raising additional debt capital and/or equity capital to fund the respective transaction.

We support our clients in negotiating sales and purchase agreements, shareholder agreements and assist in closing the transaction.

We provide access to experienced post-execution partners who can supervise, manage and/or operate the investment post-acquisition.

1.2 Capital Raising (Lead Arrangements)

We provide capital raising services (lead arrangements) to our clients globally. This includes the raising of debt capital and/or equity capital for general business expansion, recapitalization and/or acquisitions.

We advise our clients on the most suitable capital structure and assist in establishing specialized investment vehicles if required.

Furthermore, we provide our clients access to our distinct network. Our network includes:

- Hedge Funds

- Venture Capital

- Institutional Investors

- PE Funds

- Insurance Companies

- Family Offices

- Fund of Funds

- Sovereign Wealth Funds

- HNWI Investors

1.3 Private Equity

We utilize our vast experience and network to assist our clients in placing their private equity capital.

Our team will support our clients during the below stages of private equity transactions.

Origination

Financing

Acquisition

Exit

We identify target companies that are consistent with our clients’ PE investment strategy.

We assist our clients in raising additional debt capital and/or equity capital in order to fund the respective transaction.

We support our clients in negotiating respective transaction agreements and assist in closing the acquisition transaction.

We conduct thorough due diligence on potential target companies, advise our clients on target company valuation and recommend the most suitable financial structure.

Furthermore, we provide ideas and strategies in regards to post-acquisition value creation initiatives.

We help our clients to identify the most suitable divestment options and provide support during the exit transaction execution.

1.4 Public Offerings (Debt and Equity)

We act as lead advisor to our clients who are seeking to raise debt capital or equity capital on public markets and assist them during the entire Bond/IPO listing process.

Our services include:

- Company valuation

- Preparation of offering

- Compliance Advisor (Nasdaq Dubai Growth Market)

- Organizing legal advice, preparation and drafting of listing documents

- Organizing road shows, book building and pricing

- Organizing distribution

1.5 Feasibility & Market Studies

We enable our clients to make the right decisions about the viability of their business plans and/or projects by providing feasibility and market study services.

Our services include:

- Economic analysis and project feasibility

- Stakeholder consultation and engagement

- Large-scale best use studies

- Capital requirement projections operational costing scenarios

- Market analysis and market structure reviews

- Options appraisal and due diligence

- Modeling of project demand (for new products and services)

- Competitor intelligence

Go Back to Services >

SCROLL

We manage the global and diverse portfolios of family offices, as well as high net-worth (HNW) professional investors and we provide asset management services to domestic / foreign funds.

2.1 Family Offices and HNW Investors

We provide holistic asset management services to Family Offices and HNW Investors globally.

Our services include:

- Wealth Planning

- Tax Planning

- Wealth Management

- Family Governance

- Trust & Corporate Services

- Charity & Philanthropy

- Real Estate

2.2 Domestic / Foreign Funds

We work with fund sponsors and investment advisors to provide establishment, execution, operational and compliance capabilities, as well as access to our network of internationally recognized custodians, fund administrators, fund auditors, top-tier banking platforms and leverage providers.

Working with us saves time and allows our clients to establish a track record, to gain experience and competence, while at the same time building critical mass.

Fund sponsors and investment advisors can ensure full cost control through our flat fee structure and have the ability to select the level of services provided by us while at the same time, provide the highest level of service and professionalism to their existing client base.

Go Back to Services >

SCROLL

Our focus lies on the development, establishment and management of collective investment funds, such as private equity funds, hedge funds, venture capital and other alternative investment funds. We have developed private equity funds, focusing on projects in infrastructure, resources, renewables and other sectors globally.

Furthermore, we have developed specific investment strategies for the energy and infrastructure sector, namely our Captive Private Equity Investment Strategy, tailored to the financing needs of governments, semi- governments and large private conglomerates.

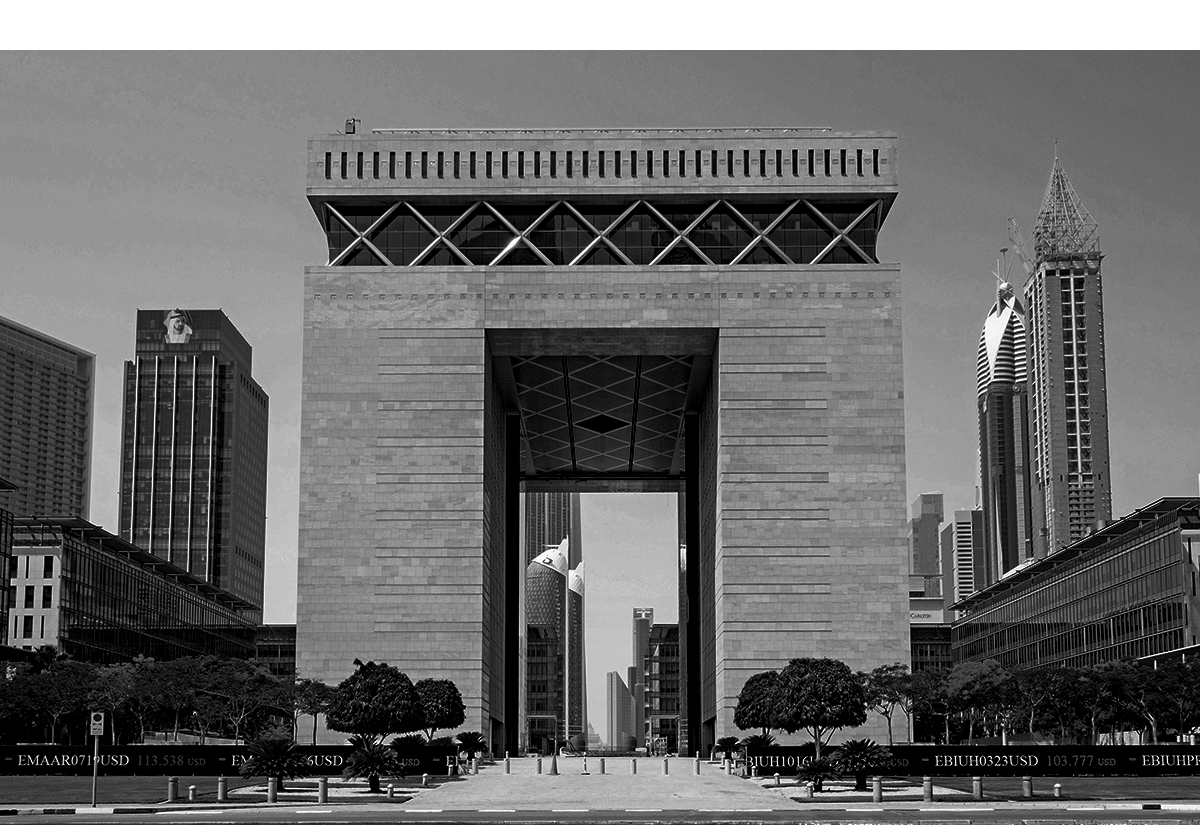

Our funds are managed out of the Dubai International Financial Centre (DIFC), and we appoint external and independent auditors, custodians and administrators to all our funds.

3.1 Fund Development

We assist our clients to develop specific fund concepts and strategies.

3.2 Fund Establishment

We advise on and recommend the most suitable fund structure to our clients. Furthermore, we provide fund distribution and placement services to funds that are managed by us.

3.3 Fund Management

We ensure fund strategy implementation and provide holistic fund management services.

Go Back to Services >

C O N T A C T U S

Office 2202B, South Tower

Emirates Financial Towers

Dubai International Financial Centre

P.O. Box 506597

Dubai, United Arab Emirates

Read More >>

Phone : + 971 4 447 7672

Fax : + 971 4 447 7671

Email : info@emirates-capital.com

By ticking this box, you consent and accept to send this information in order to receive a response to your request.

The personal data (name, email, subject, message) will be used to process and respond to your request.

Copyright Ⓒ 2024 Emirates Capital - Authorized and Regulated by the Dubai Financial Services Authority

Terms and Conditions of Use